This article will learn you how to bookkeep Quickorder Pay payouts received from Adyen.

In this example a restaurant has sold food and beverages for 10.000,- Customers gave 1000,- in tips.

All the 11.000,- was paid with Quickorder Pay. Either on a terminal or paid online through the Quickorder App. Payments can be made with Vipps, MobilePay, ApplePay or by card. How and where it was paid is not important all the money is owed to the restaurant by Adyen.

The Quickorder accounting integration posts the turnover with the payment as a counter account: There are NO tips or Adyen fees. ONLY the turnover is transferred.

This is how it will look in the accounting system:

- Food turnover - 4.000,- (kredit)

- Beverage turnover - 4.000,-(kredit)

- Adyen 10.000,- (Debit)

- VAT (25%) - 2.000,-(kredit)

Do NOT use the bank account as the bookkeeping account for the Quickorder Pay (Adyen) pay type. Create an interim account where you can follow what Adyen owes the restaurant.

Now you receive money from Adyen. The amount in the bank is 10.828,12

How does this add up?

To bookkeep this payout, you need to find the payout information in Quickorder Backoffice. If you are an accountant, you can get a login to your clients Quickorder system. This is free.

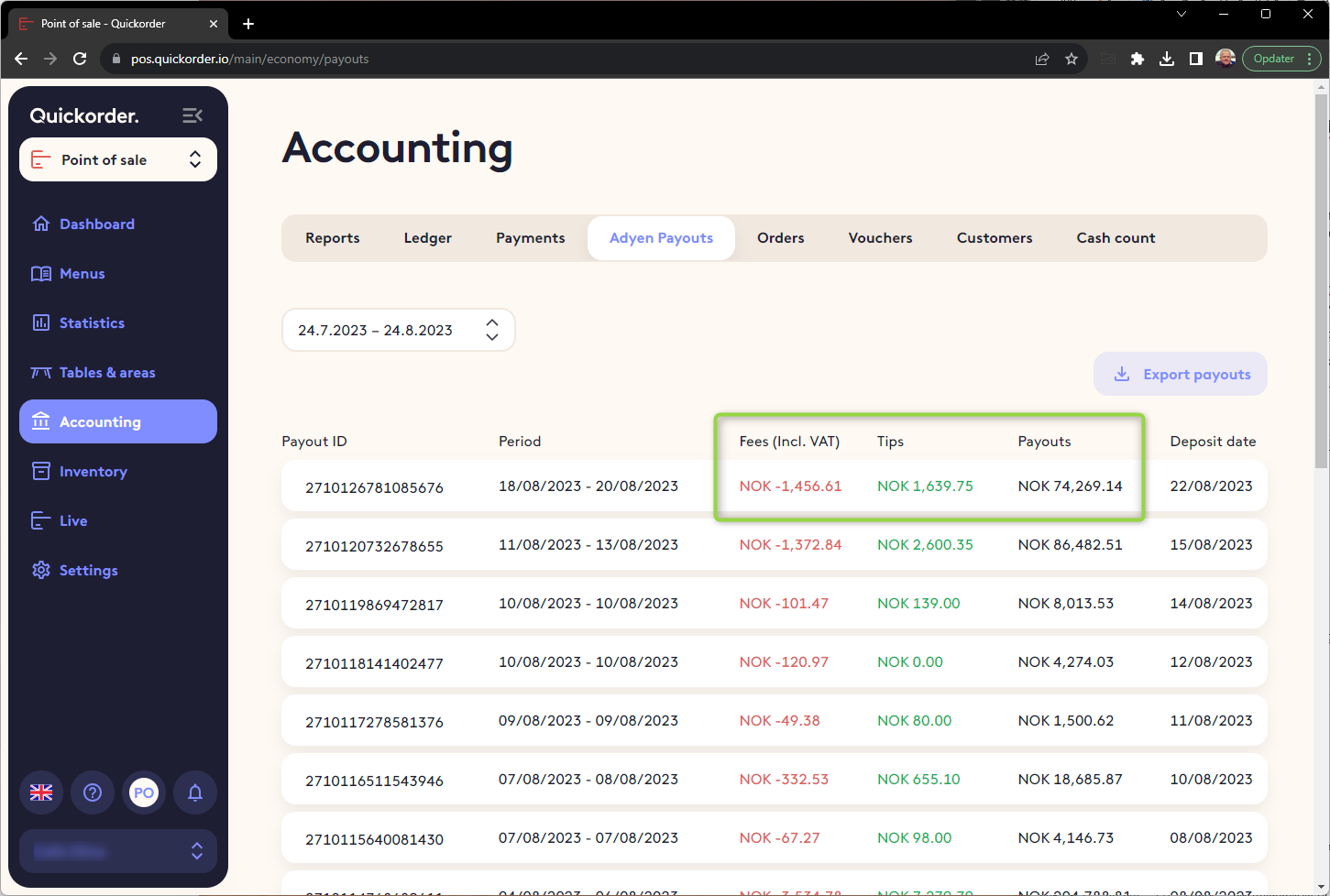

Go to Accounting -> Adyen Payouts

https://pos.quickorder.io/main/economy/payouts

Find the payout that matches the amount in the bank. You need to know the fees amount and the tips amount. In the example the numbers would be:

- Payout: 10.828,12

- Tips: 1.000,00

- Fee (incl. VAT) 171,88

This is how to bookkeep the payout:

- Bank 10.828,12 (Debit)

- Fee 171,88 (Debit) (With VAT code for 25% input VAT)

- Tips - 1.000,00 (Credit)

- Adyen - 10.000,00 (Credit)

Now the Adyen account is 0,- as they have paid what they owed. The bank account adds up and you have bookkept fees and tip.

Here you have a list over normal used account numbers:

Norway:

15xx - Adyen

1910 - Bank or 2380 - Credit account

2701 - Output VAT (VAT code 3)

2711 - Input VAT (VAT code 1)

30xx - Turnover with VAT

39xx - Tips

77xx - Fee

Denmark:

10xx - Turnover

10xx - Tips

13xx or 44xx - Fee

56xx - Adyen

5820 - Bank or 6750 - Credit account

6902 - Output VAT (VAT code U25)

6903 - Input VAT (VAT code I25)