In Backoffice, it is possible to set up an integration for Xero, so that you can transfer your accounting information from Quickorder POS to Xero.

- Open your internet browser on your computer and log in to pos.quickorder.io

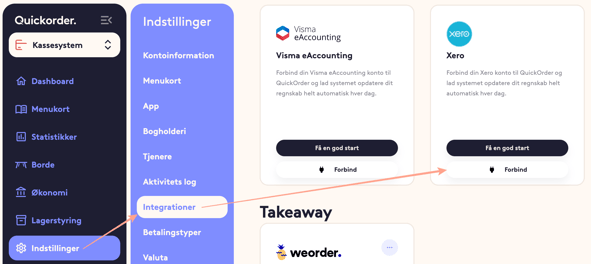

- Go to Settings > Integrations

- Find Xero and tap Connect

- Now you can enter your login details for Xero. Then press Log in

- Select a department in Xero and press Connect

- Tap the three dots in the right corner and select Edit

- Here, in the lower box, you must select which department you want to connect with Xero. Then press Activate

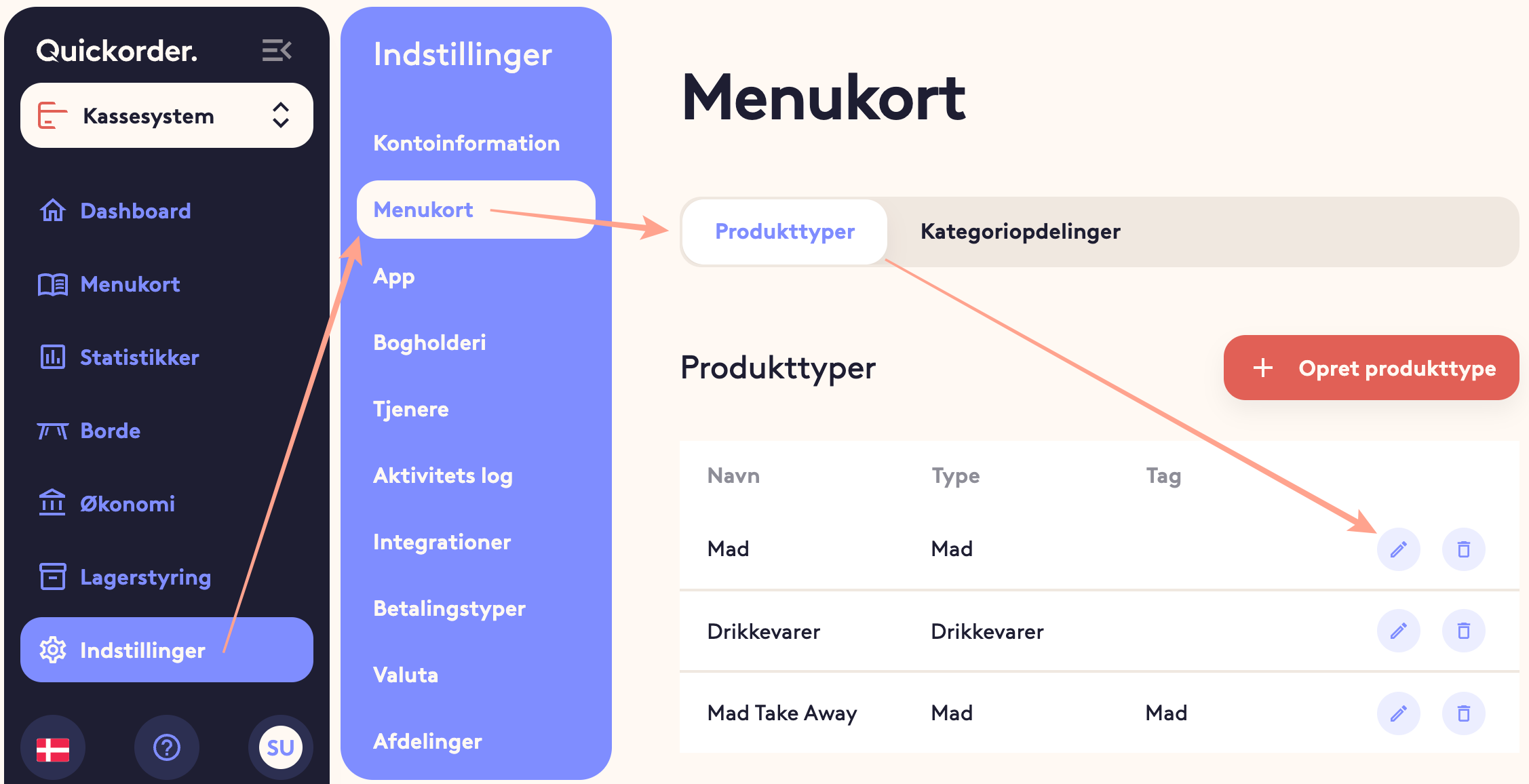

2. Set up Product Types

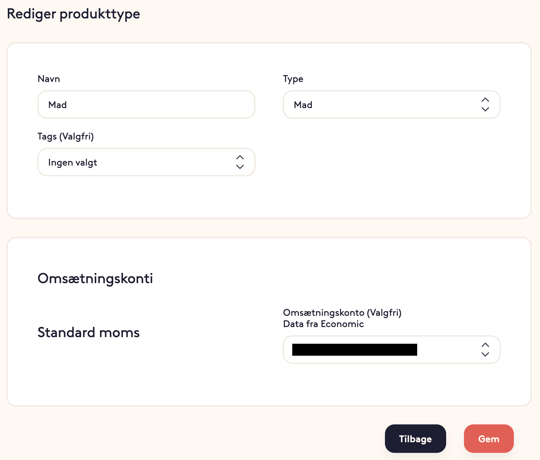

- Under Settings > Menu card > Product types , press the small pencil next to each payment type

- For each product type, indicate which account in Xero, where the revenue for the relevant product type must be booked

NB! Please be aware that the revenue is entered as a credit and that the account must therefore be in the profit and loss account as a starting point. Consult an accountant or bookkeeper if you are in doubt - Tap Save

- Repeat the above with the remaining product types

5. Limitations in the Integration

Please note that the figures exported (both CSV and the direct integrations) have some limitations that must be taken into account manually:

- Tip

- Tips are not included in the export and must therefore be entered manually.

- Cash differences and Movements

- The cash register and the movements it produces are not part of the export. These can advantageously be booked based on the voucher, which is created when the cash register is closed.

- Cash sales are of course transferred.

6. Good advice and tips

Be sure all corrections are made before transferring to the financial system. If you discover an incorrect setup (for example, a wrong account on a product type), then in many cases it can be easier to counter-post the old postings and transfer again.

Always make sure to reconcile the numbers you have in Quickorder with what you have registered in your bookkeeping at regular intervals. It is very time-consuming to correct differences afterwards.

7. Transfer of gift card sales and turnover with gift cards.

In order for gift cards to be transferred, it is necessary to activate this

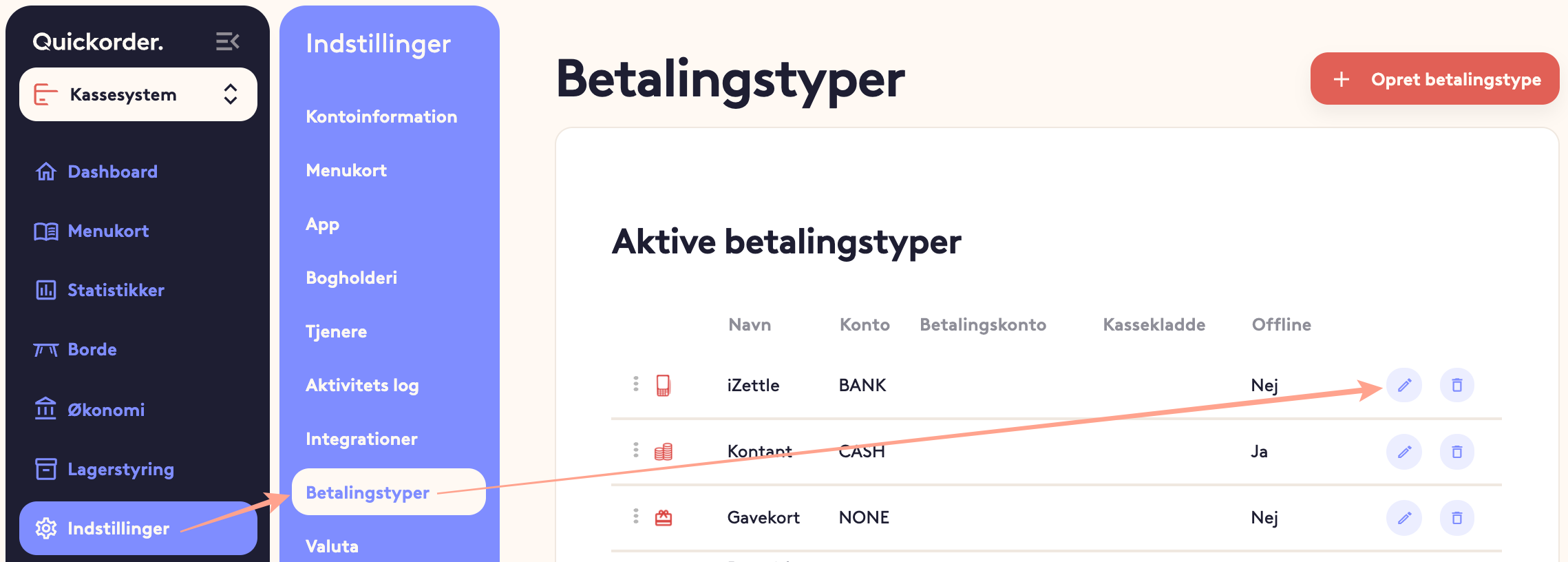

- Go to Settings -> Payment types

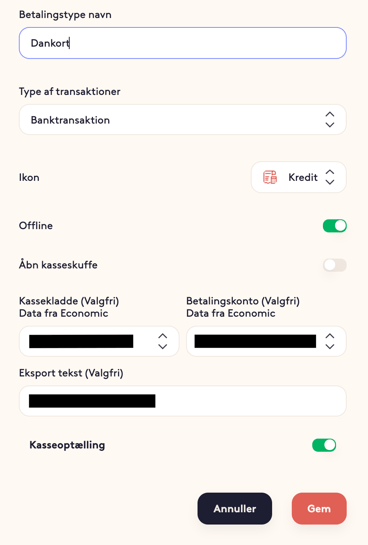

- Select the pencil on "Gift card" and make sure that transfer to accounts is switched on

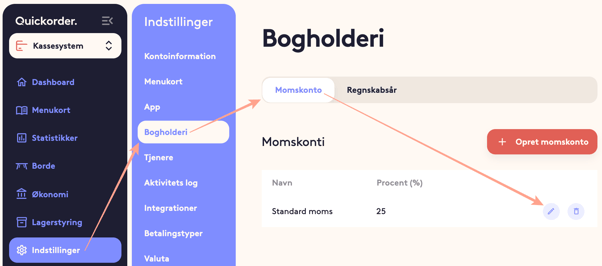

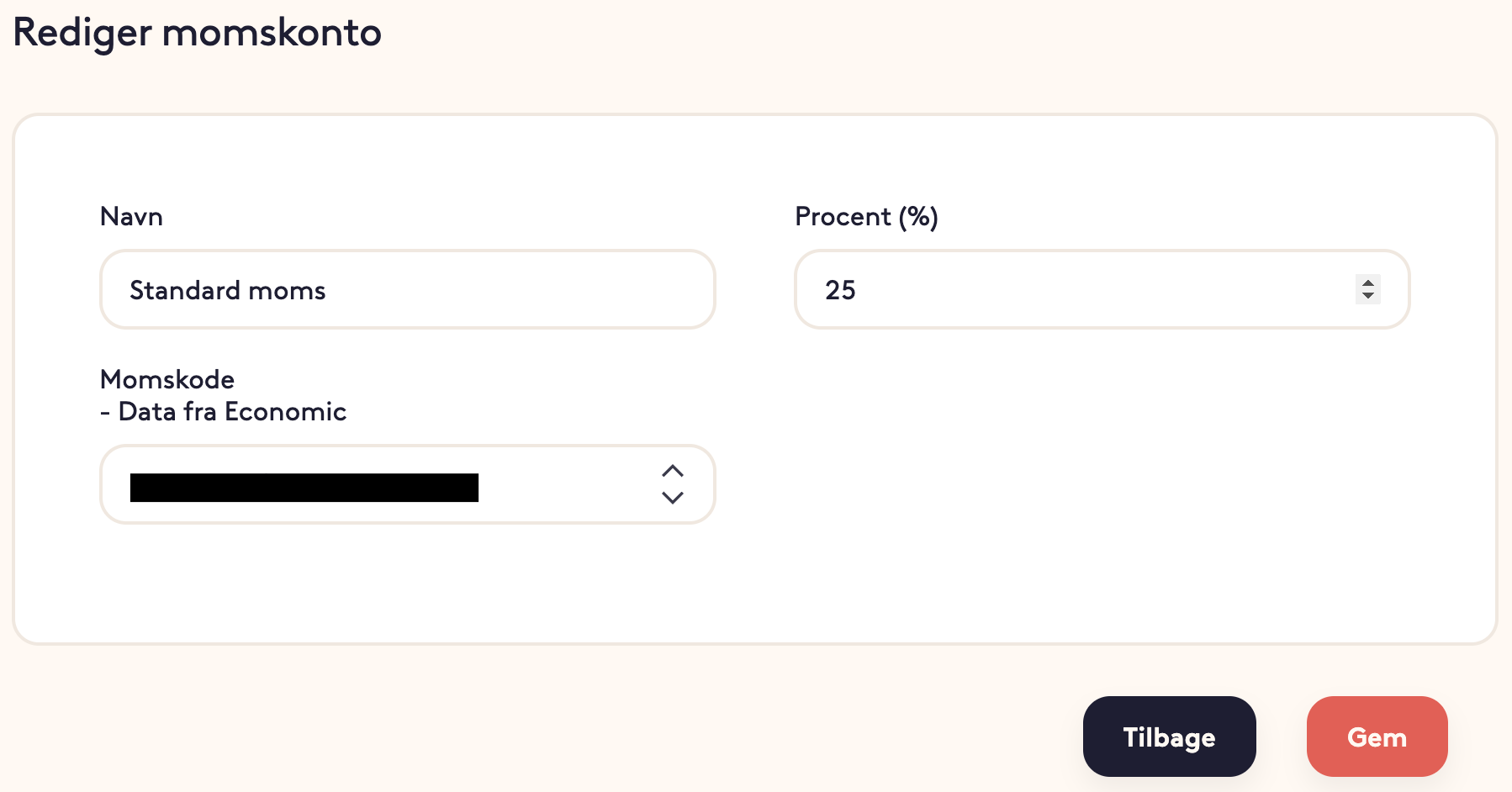

- VAT account must be selected. Quickorder posts gift card sales with VAT, as prescribed by the latest VAT rules. When gift cards are used as a means of payment, VAT is applied to both debit and credit of the item sold.