This article will show you how to integrate e-Accounting with Quickorder

Table of contents

3. Transfer of vouchers to the accounting system

4. Transfer of gift card sales and turnover with gift cards.

1. Establish connection

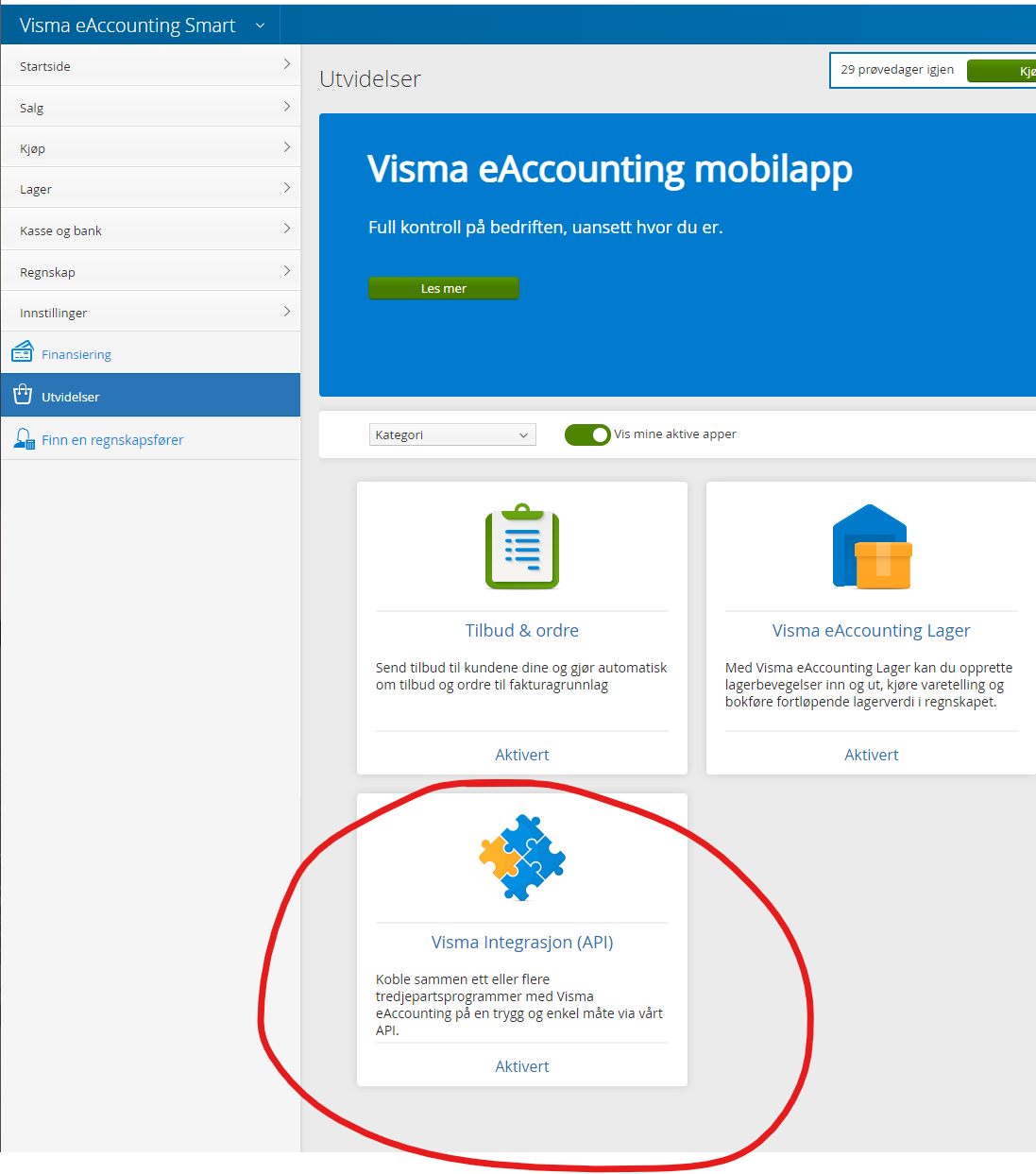

Before you start the integration, you must have the correct version of eAccounting. There must be a version where it is possible to activate the API (integrations). It is possible in the "Smart" and "Pro" versions. During extensions, Visma integration (API) must be active.

Another important thing is to check that there is the correct VAT code associated with each account in eAccounting. This is the one that controls which VAT code is used for bookkeeping.

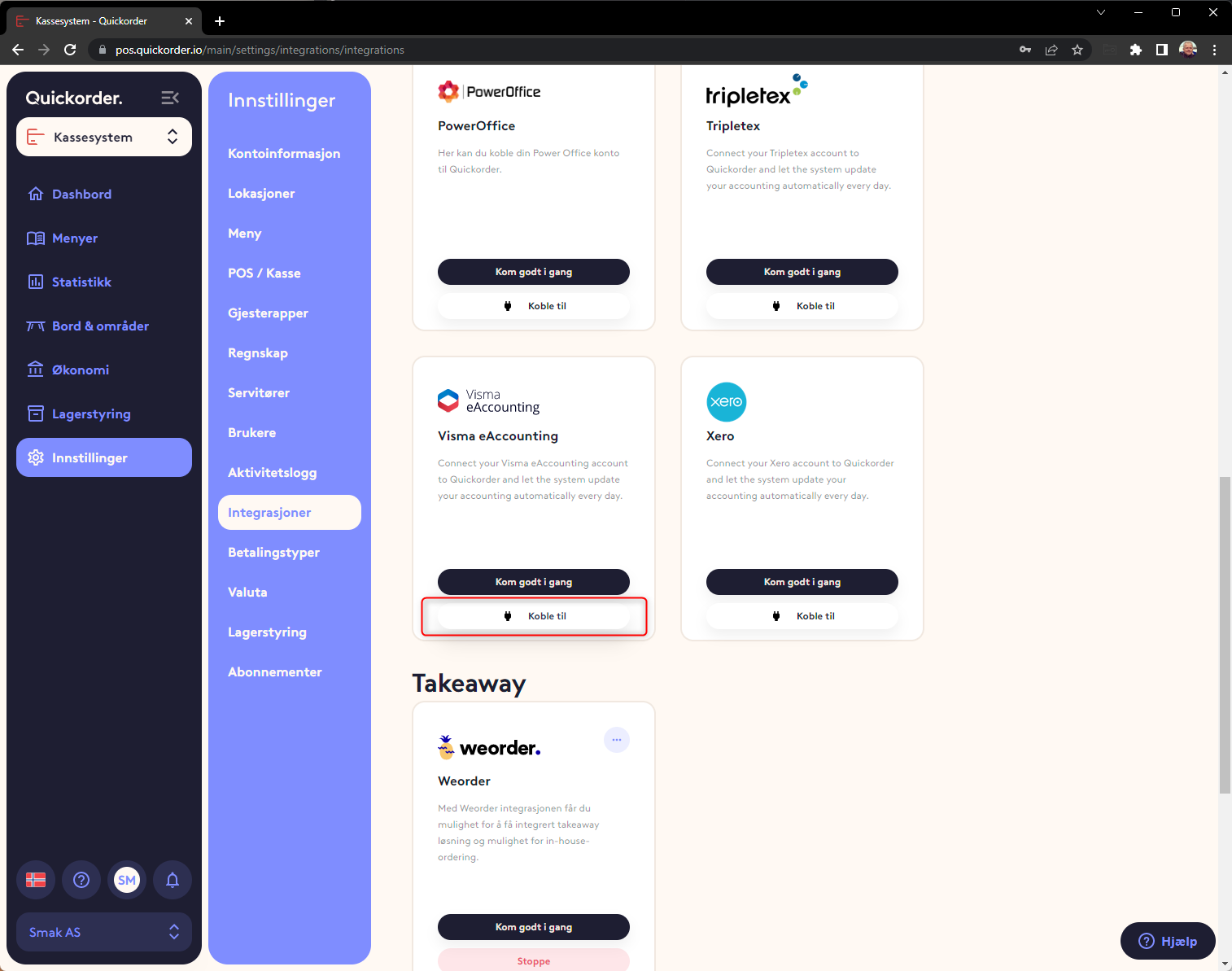

The next step is to connect Quickorder and eAccounting together. This is done in the Quickorder back office under Settings -> Integrations.

Press "Connect" and log in to your eAccounting account.

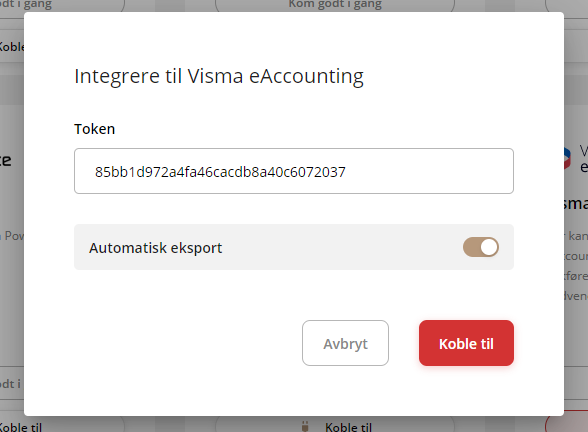

It is possible to activate "Automatic export". This ensures that it is automatically transferred from the day you activate it and onwards. One voucher is created in eAccounting per day.

But if this is activated, then all accounts MUST be set up as described under on the same day, otherwise it will not work. If you want to transfer back in time, follow the instructions below. This automatic transfer can be started later if you want.

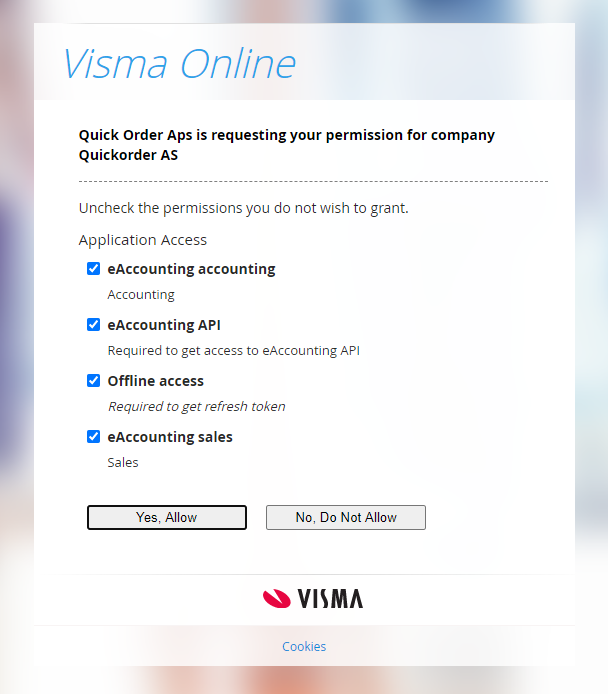

You will then get this image:

Press "Yes, Allow"

The 2 systems are then connected.

2. Setup in Quickorder

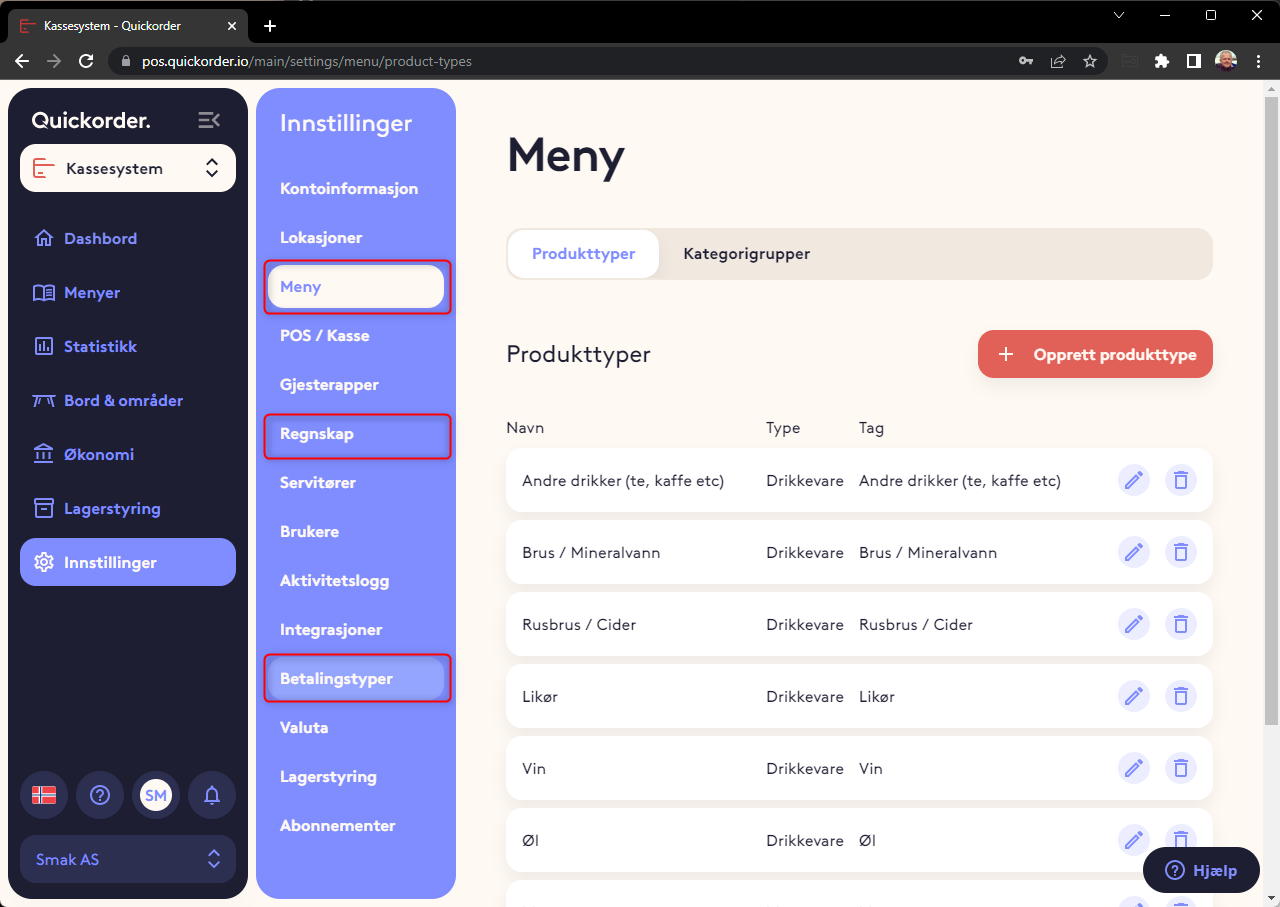

There are generally 3 places where the account number or VAT code must be linked under settings in Quickorder. It is:

- Menu -> Product types (Sales accounts are entered here. Typically the 3000 series)

- Accounting (Enter VAT codes here)

- Payment types (The account for the various payment types is entered here)

1. Menu - Product types.

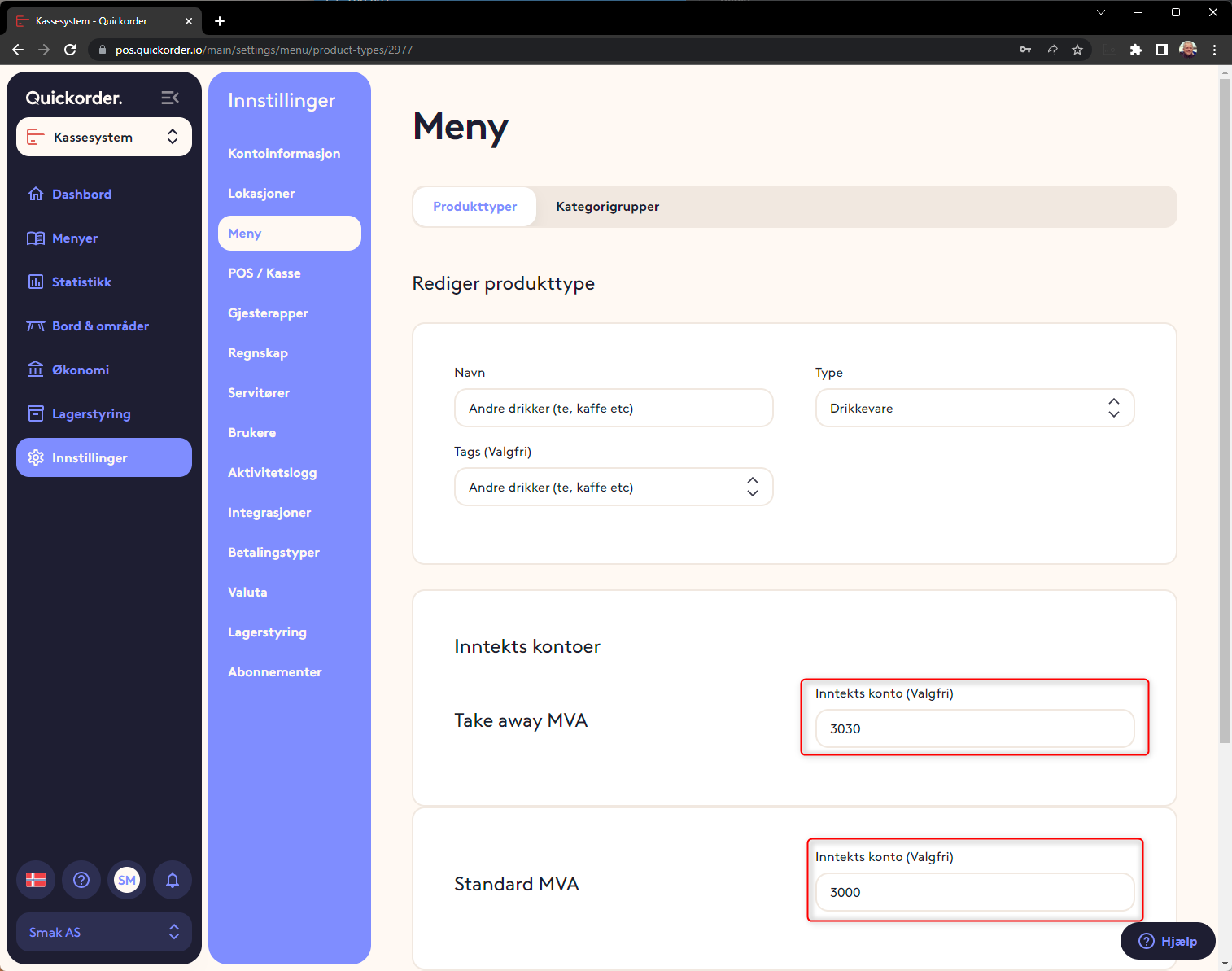

For each product type, the correct account for the sale must be assigned. One for turnover with normal VAT and one for turnover with reduced (takeaway) VAT.

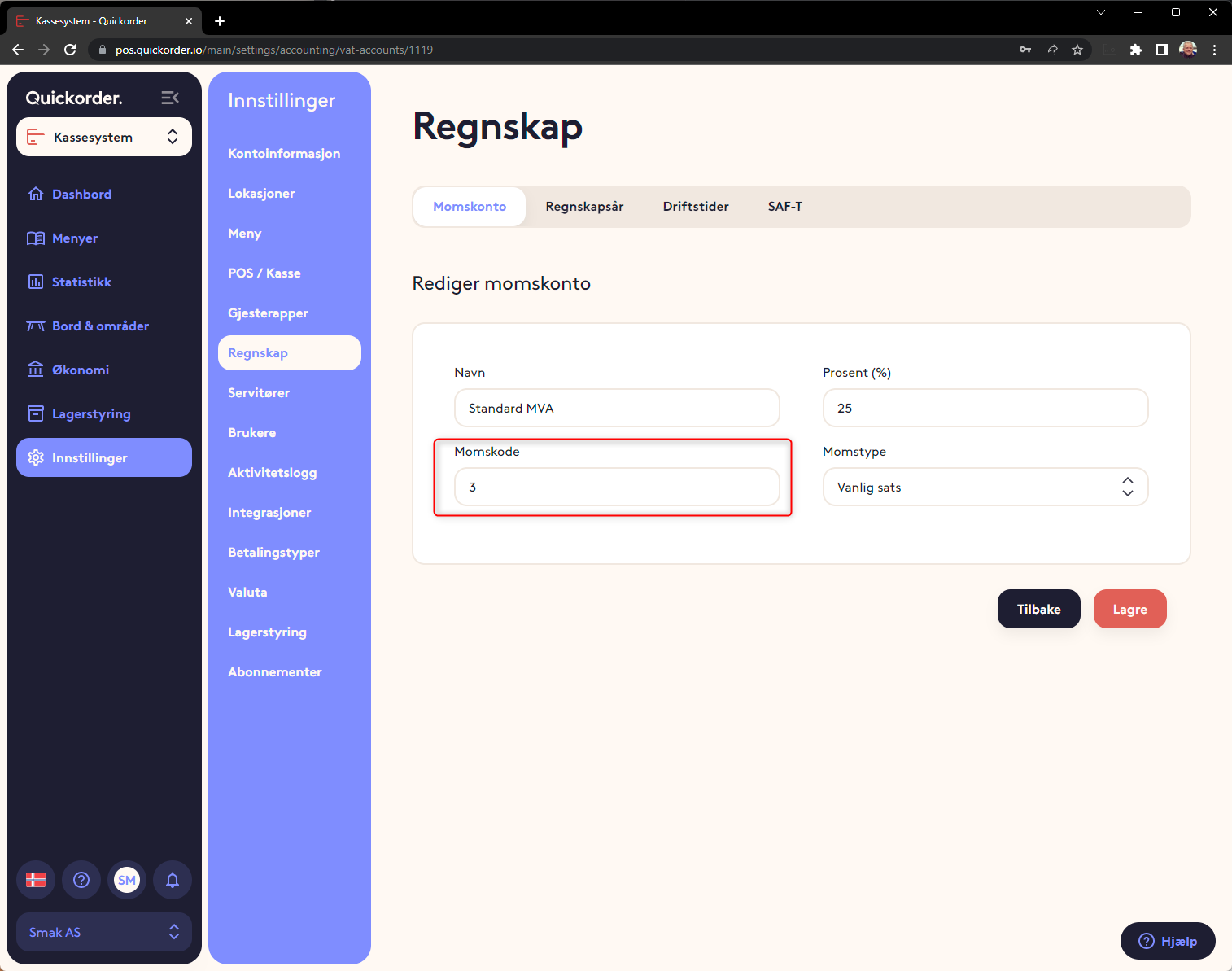

2. Accounting - VAT codes

A VAT code must be entered for each VAT account

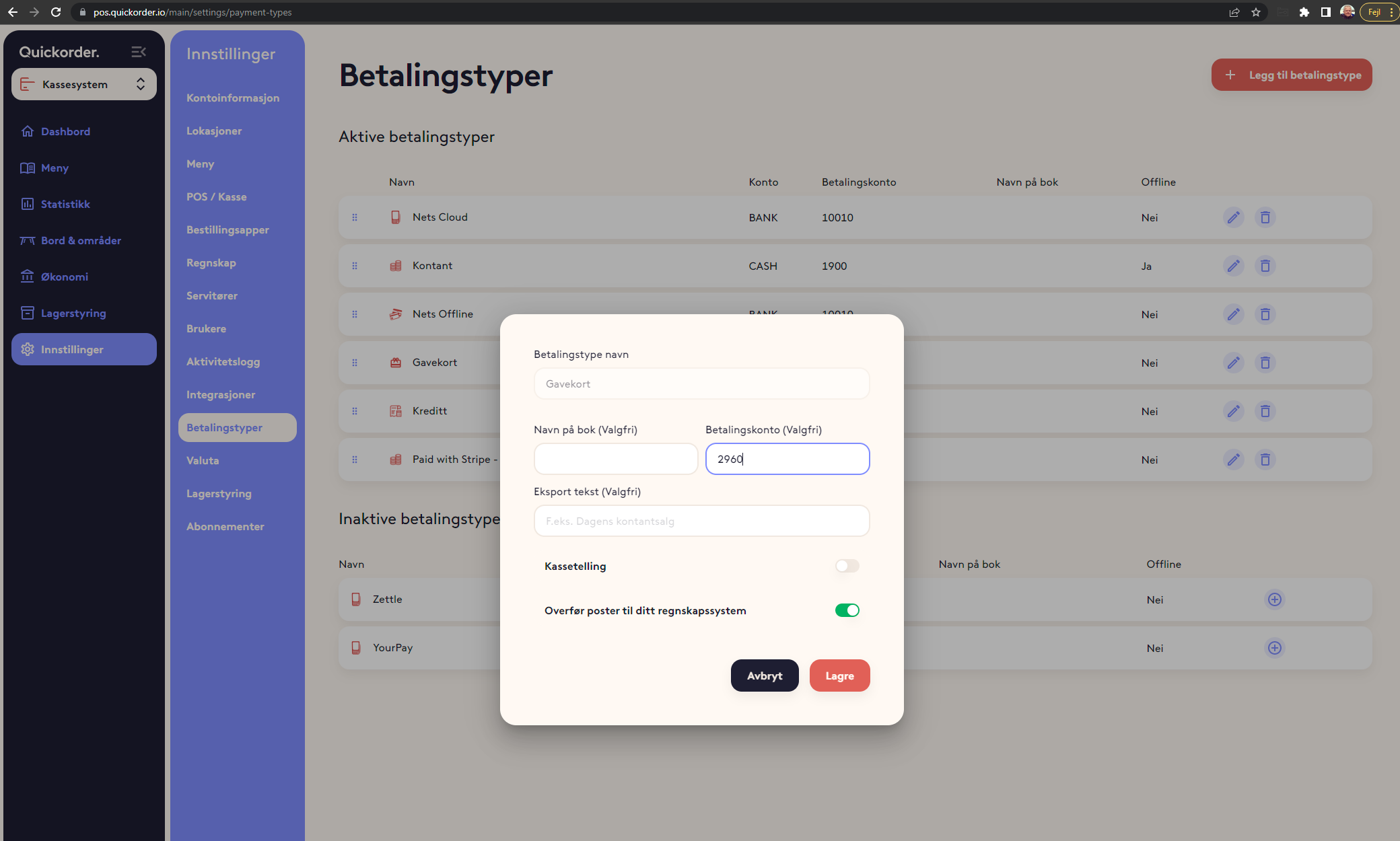

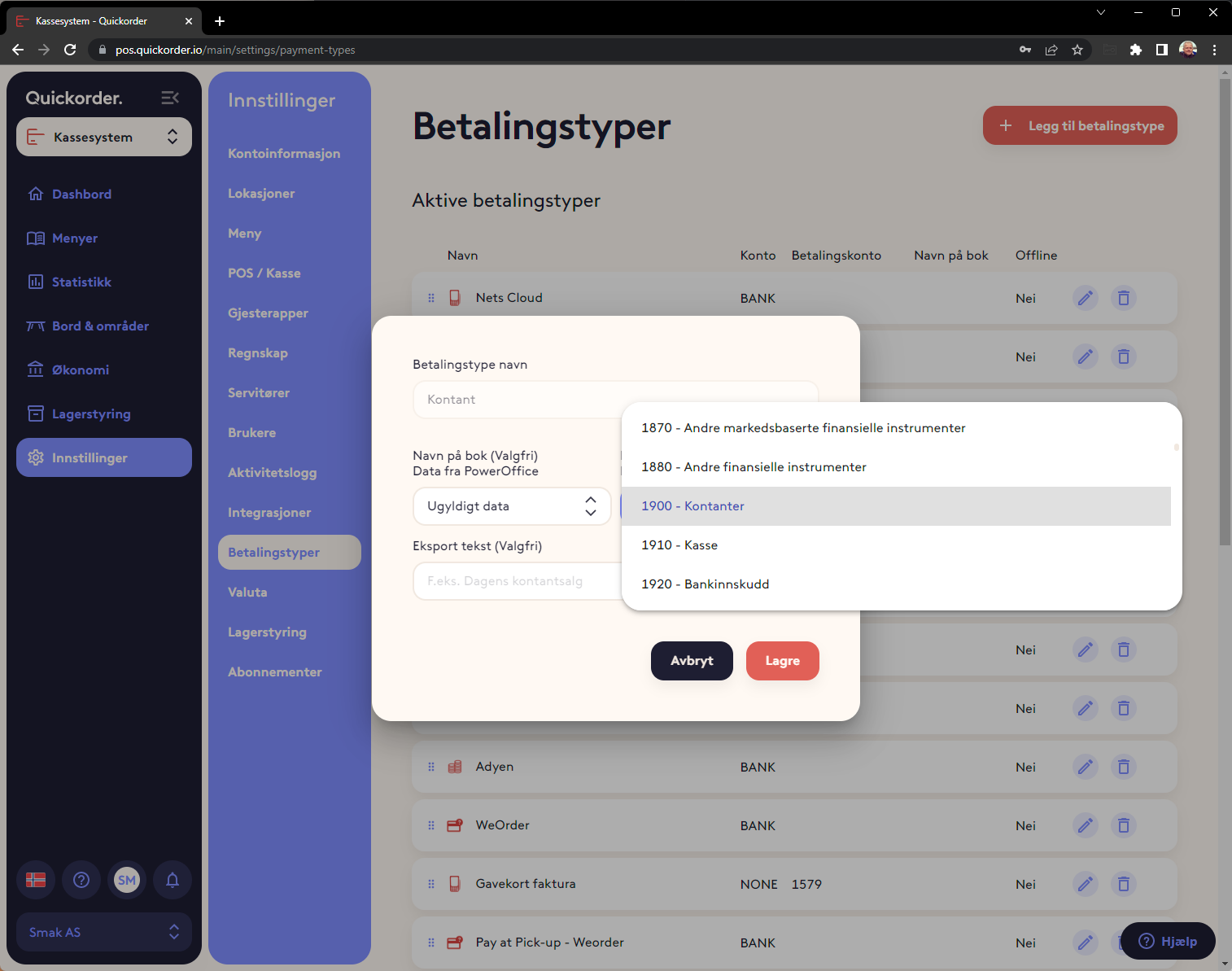

3. Payment types

An account must be entered for each payment type. Here it is important not to deposit an account for the bank directly. A payment at a card terminal must be made via an auxiliary account. Typical in the 15xx series. 1900 is usually cash.

When the 3 are set up, it is ready to export to Visma e-accounting

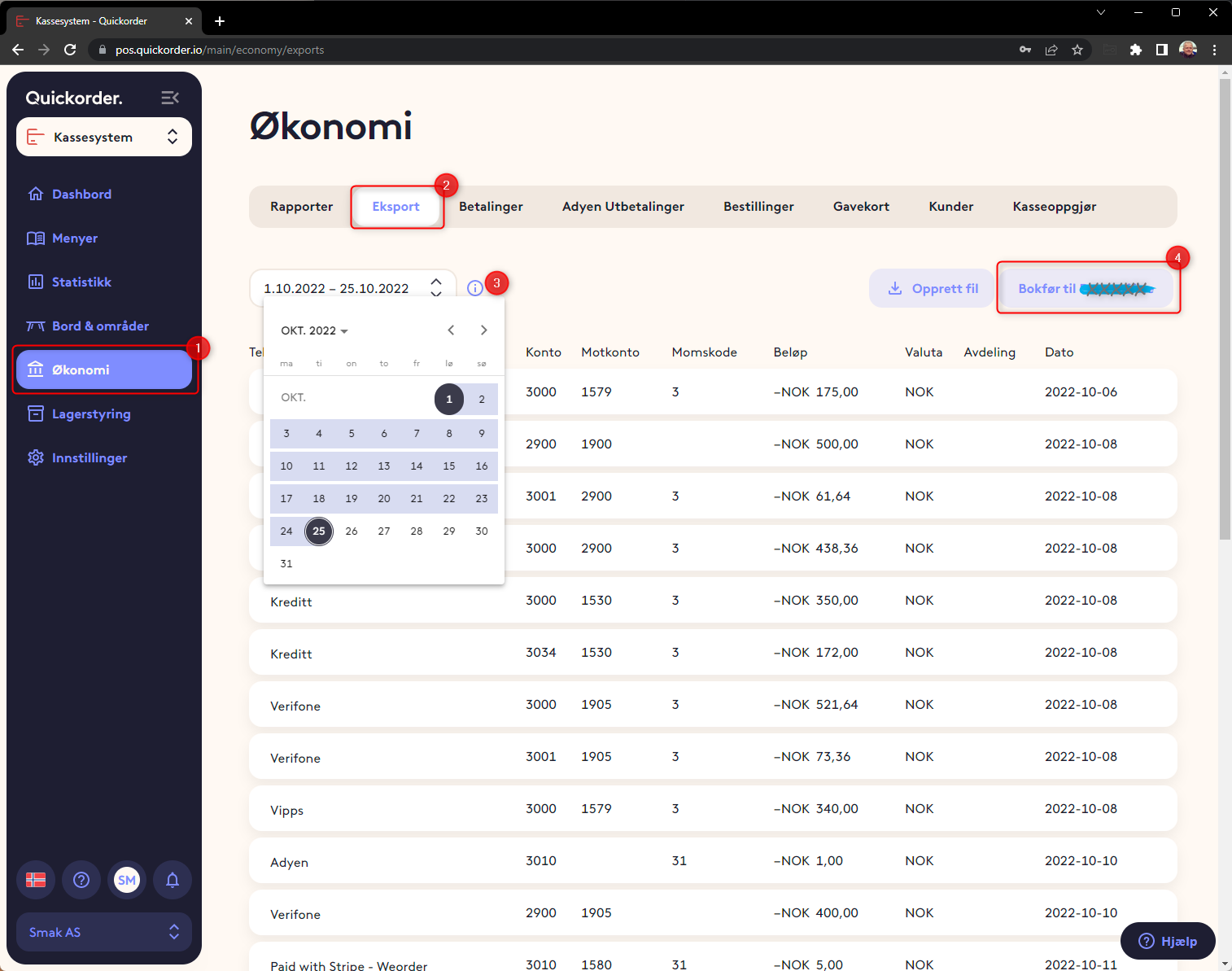

3. Transfer of vouchers to the accounting system:

Select Finance -> Export and select a period.

Now a display of vouchers will appear. Then press "Post to e-Accounting"

What is transferred is all daily sales

All movements at the cash register other than cash sales must be entered manually.

Tips must also be entered manually.

4. Transfer of gift card sales and turnover with gift cards.

In order for gift cards to be transferred, it is necessary to activate this

- Go to Settings -> Payment types

- Select the pencil on "Gift card" and make sure that transfer to accounting is switched on